Salary ot calculator

Web However because he worked an extra 10 hours his overtime pay would be calculated by multiplying 10 by one and a half times 15 the extra working hours. Due to the nature of hourly wages the amount paid is variable.

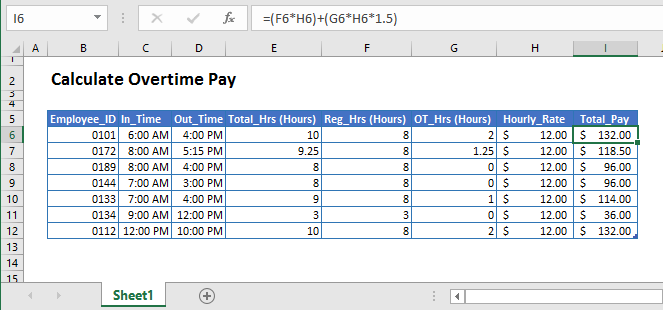

Calculate Overtime In Excel Google Sheets Automate Excel

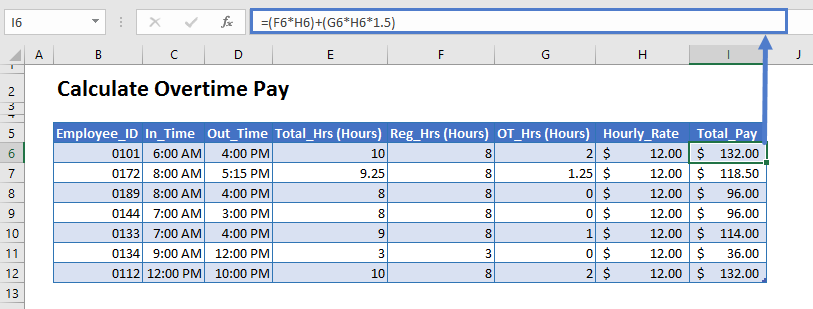

Web The employees total pay due including the overtime premium for the workweek can be calculated as follows.

. To use the tax calculator enter your annual salary or the one you would like in the salary box above. Try out the take-home calculator choose the 202223 tax year and see how it. For employees who are between 16-17 years.

All other pay frequency inputs are. You can claim overtime if you are. Web The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

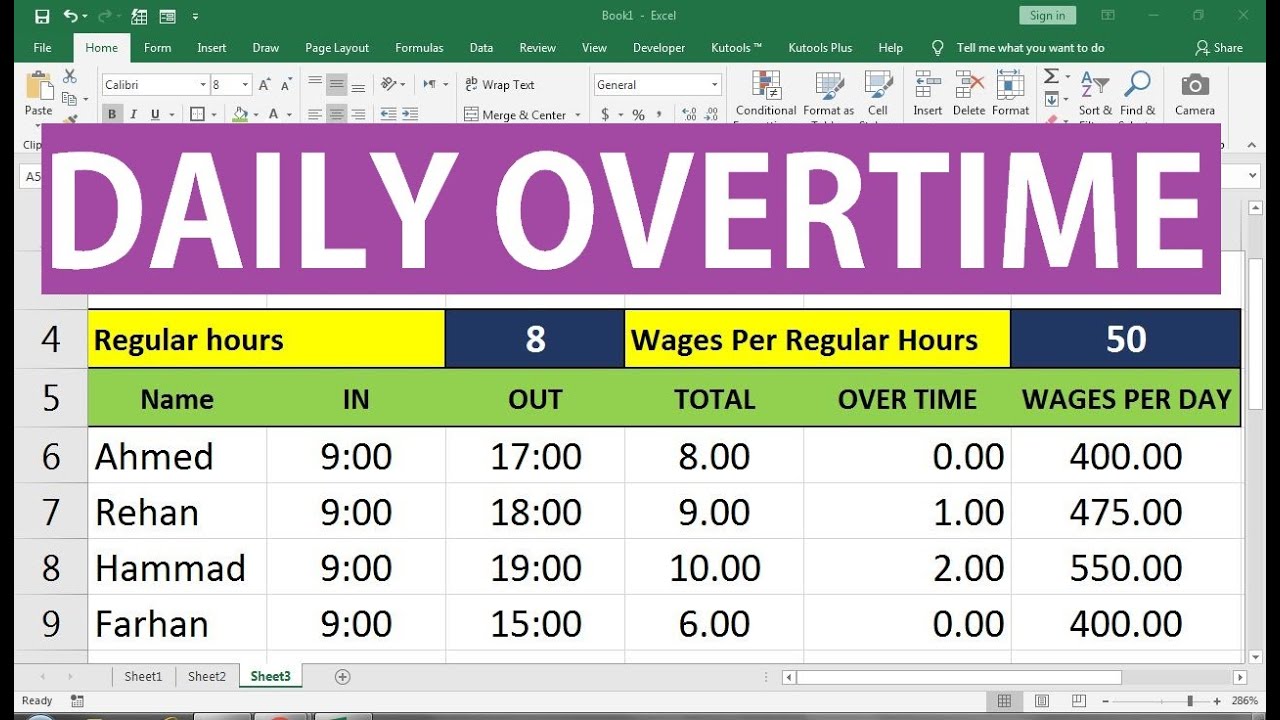

Then calculate the overtime pay rate by multiplying the hourly rate by. RM50 8 hours RM625. Web California overtime law requires employers to pay nonexempt employees who are 18 years of age or older for overtime hours worked.

Web The Fair Labor Standards Act FLSA Overtime Calculator Advisor provides employers and employees with the information they need to understand Federal overtime requirements. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 1500 per hour x 40 600 x 52 31200 a year.

Web For example. Wage for the day 120 11250 23250. Web The base salary for Occupational Therapist ranges from 86177 to 102482 with the average base salary of 94076.

30 x 15 45. Web In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. Dont forget that this is the.

Web Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. 1200 40 hours 30 regular rate of pay. If you are earning a bonus payment one.

Web How to use the Take-Home Calculator. For the cashier in our example at the. Web If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

Federal tax State tax medicare as well as social security tax allowances. Web Overtime Security Advisor helps determine which employees are exempt from the FLSA minimum wage and overtime pay requirements under the Part 541 overtime regulations. 15 times 10 hours is.

Overtime pay of 15 5 hours 15 OT rate 11250. Web Regular pay of 15 8 hours 120. The total cash compensation which includes base and.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal. Web Divide the employees daily salary by the number of normal working hours per day.

Overtime Calculator Workest

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

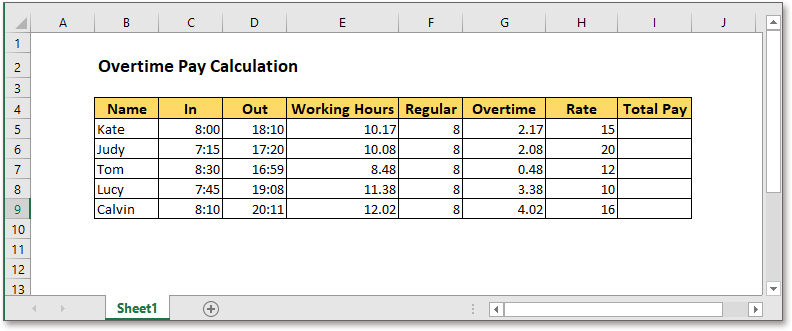

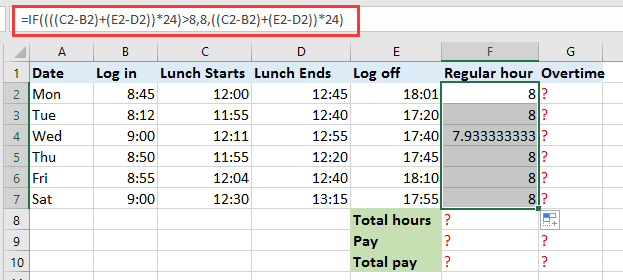

Excel Formula Basic Overtime Calculation Formula

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Overtime Pay Calculators

Excel Formula Calculate Overtime Pay

How To Calculate Overtime Pay In Excel Accounting Education

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Overtime Pay From For Salary Employees Youtube

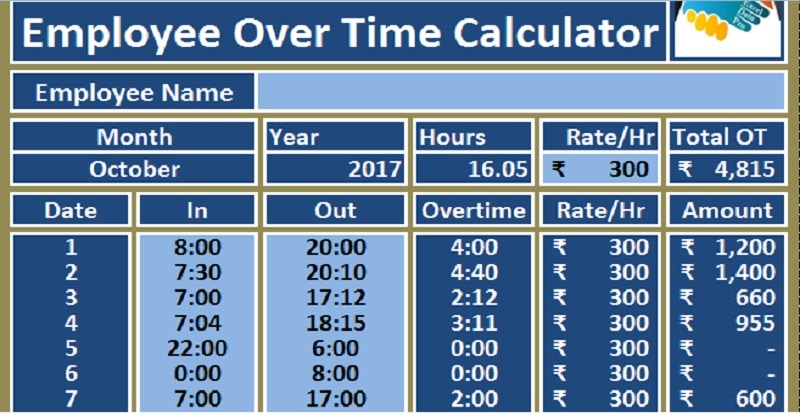

Download Employee Overtime Calculator Excel Template Exceldatapro

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

How To Quickly Calculate The Overtime And Payment In Excel

Overtime Calculation Formula In Excel Youtube

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Calculator